Debt Solutions

Personal Insolvency Agreement

A personal insolvency agreement is a flexible way to come to an agreement with your unsecured creditors.

Benefits of a personal insolvency agreement:

- May pay back less than what you owe

- Transfer an asset to settle the debt

- Make regular, affordable repayments

- May not have to pay any more interest

A personal insolvency agreement is similar to a debt agreement, however there are differences in criteria.

Unlike a debt agreement, a personal insolvency agreement requires the process to be overseen by a Trustee as opposed to an Administrator. This makes the process slightly more formal than a debt agreement as the Trustee will need to report back to your creditors.

Still have questions? Visit our FAQs page for more information on personal insolvency agreements, call us on 1300 676 124 or request a call back.

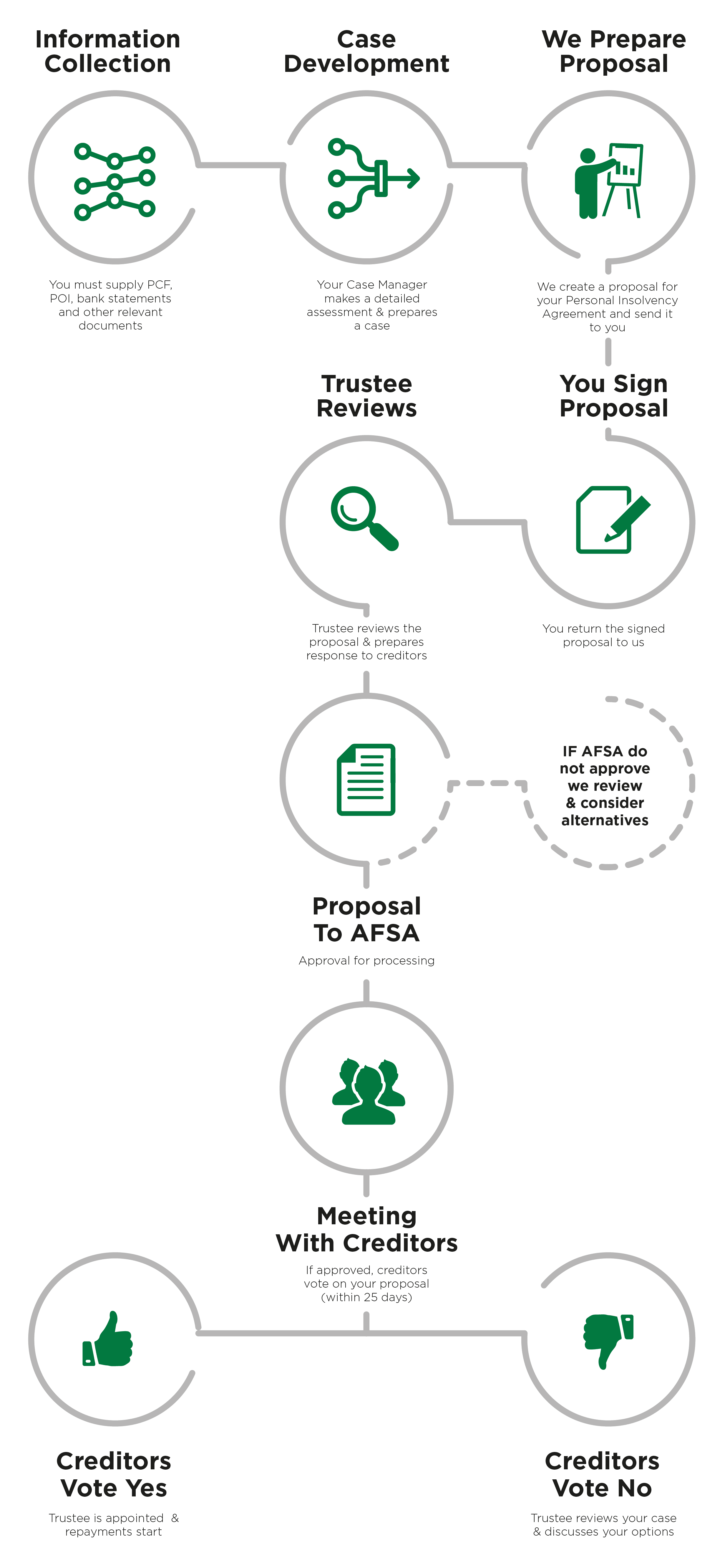

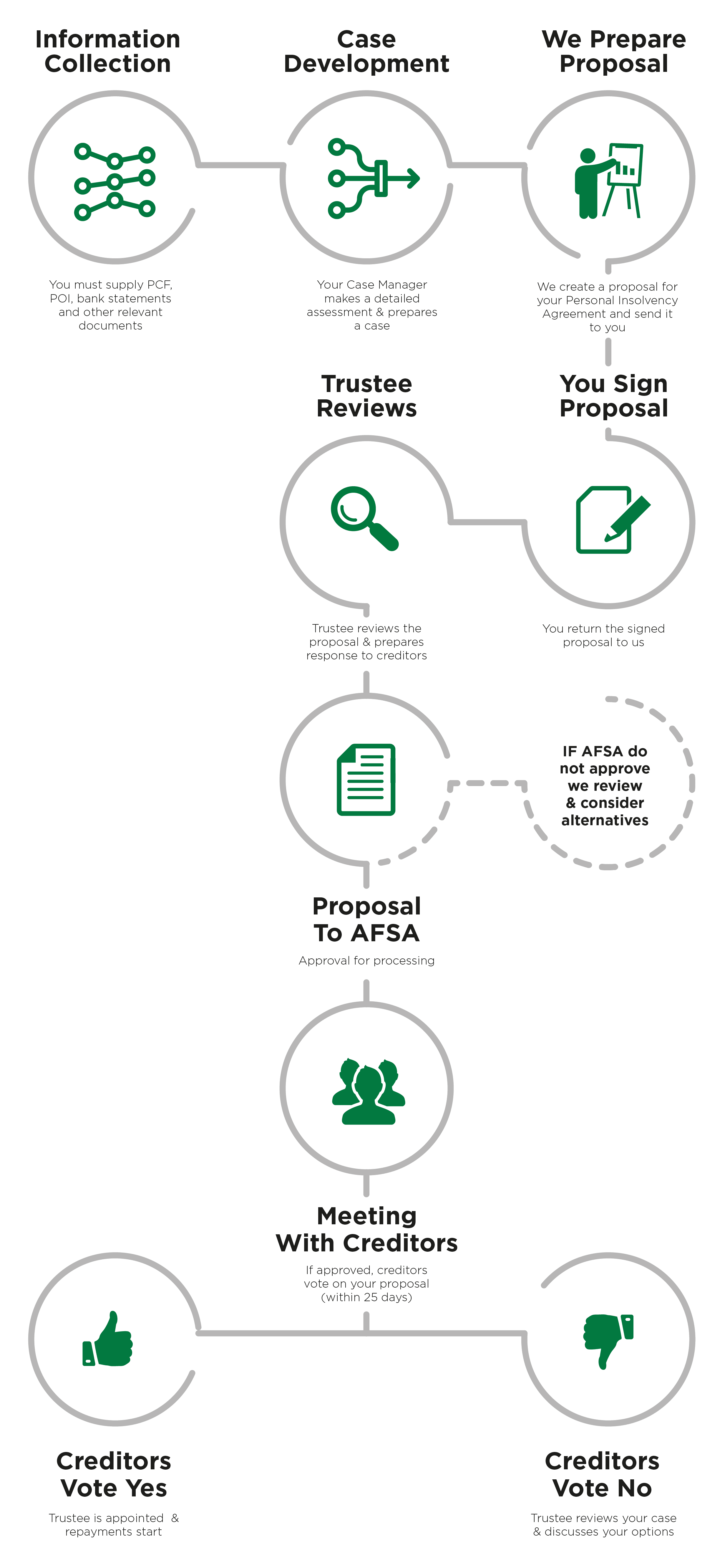

Our Personal Insolvency Agreement Process

You're an Australian resident

You're an Australian resident You're between 18-65 years old

You're between 18-65 years old You or your partner have a regular income

You or your partner have a regular income You may need to borrow money or take control of your debt

You may need to borrow money or take control of your debt You may have been declined for a loan or have trouble paying your debt

You may have been declined for a loan or have trouble paying your debt We'll work with you fully understand your financial situation

We'll work with you fully understand your financial situation We will help you understand your credit report and the areas for improvement

We will help you understand your credit report and the areas for improvement You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report

You may yourself without charge obtain a copy of your credit record and challenge any entry on your credit report If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report

If you're applying for credit restoration improvement, we cannot guarantee that all adverse credit notations are removed from your credit report We can only use our best endeavours to ensure that your credit record is true and correct

We can only use our best endeavours to ensure that your credit record is true and correct We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.

We will not provide you with any Insolvency services unless and until we've advised you that you may obtain help, free of charge, with credit and debt related problems from community based financial counsellors.